Table of Content

Along with it, policy shall specify powers/authority relating to approval/sanction of consumer finance facility. All treasury related products are processed in conformity with the Bank’s Operational, Trading, Money market, Overnight, Term placing, Deal settlement, Commercial position keeping, Treasury, Credit, Finance & other applicable policies. At that time, the partner will use the partner app to process the loan for the customers’ purchase. So let’s explore some information about the best banks for home loans in Bangladesh from today’s blog.

BRAC Bank said, “The bank’s vision is to make the app a one-stop platform for loan-related solutions for valued customers.” So, the article is about BRAC Bank Brought Digital Loan App. BRAC Bank’s Retail Banking division, established in the year 2001, provides a wide suite of products and services to cater to a multitude of retail loan requirements. The division provides home loans and car loans in addition to a wide range of other personal loans, credit cards and cash-secured loans.

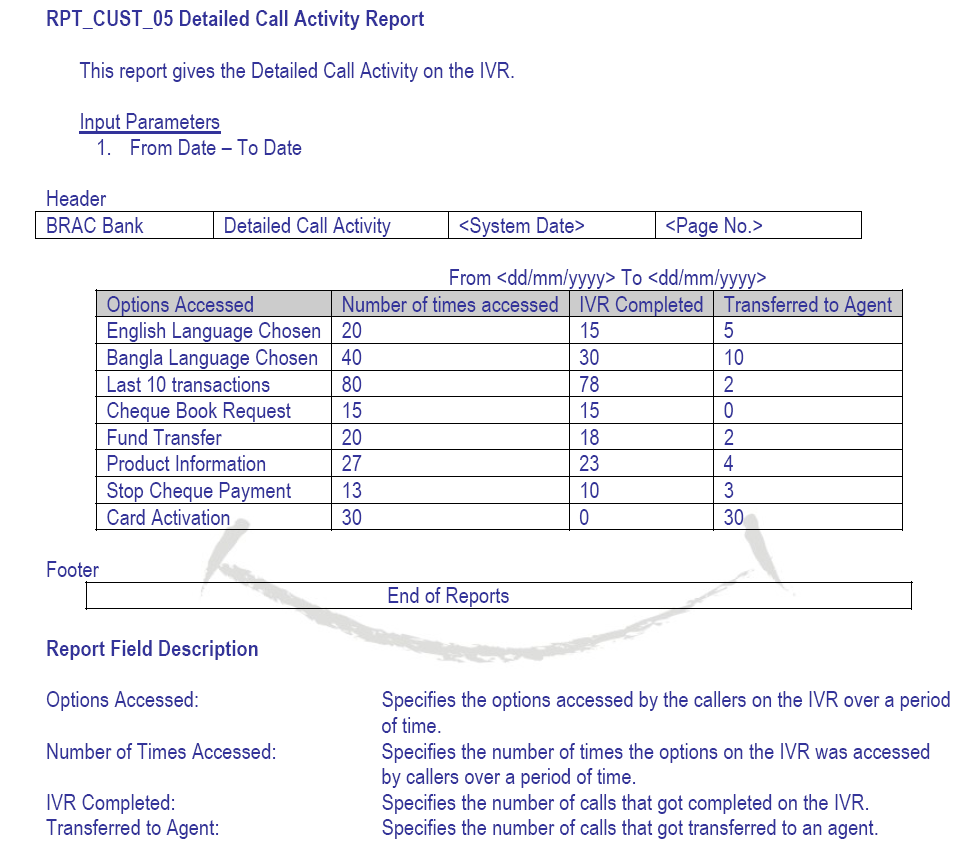

BRAC Bank Call Center

Bangladeshi nationals staying in another country and earning foreign currencies or after their return to Bangladesh within last six months can open NFCD Account. Minimum amount required to open is USD 1000 or GBP 500 or equivalent currency in Euro. Freedom Fixed Deposit is a non-transactional account that gives interest quarterly to the link account automatically. Minimum amount required to open the FFD account through physical channel (Branch/Sales RM) is BDT 100,000 upto any amount.

That recovery procedure my very product to product, but the distinct should be prescribed in such manner so that pre-planned enforcement measures could be taken immediately. Broad objective of this study is to analysis the SME scenario of Bangladesh and to assess the performance of BRAC Bank Ltd in context of highly competitive market. Along with that the report will justify how SME is contributing in socio-economic development of the country and its challenges. Client who maintains a balance between BDT 50 thousand to below 10 lacs in an average of 6 months are called excel group of guest. BRAC Bank SME division was set up to capture “Missing Middle” and to create socioeconomic impact in the country.

HSBC Brought Cash Flow Forecasting Services For Customers

IFC's work upstream with J-CAP efforts involved supporting BRAC Bank in structuring and laying the groundwork for the first ever housing finance bond in Bangladesh. The investment is also supported by the local currency facility of the International Development Association's Private Sector Window through a US dollar/BDT cross-currency swap to facilitate local currency lending. Invited customers can download ‘Shubidha’ App from Google Playstore or App Store and use the app to avail of Digital Personal Loan to purchase their desired products and services from the Bank’s enlisted partner outlets. The bank routing number is a nine-digit identification number assigned to financial institutions and this number identifies the specific financial institution upon which a payment is drawn. This very special unique code is generated with the combination of 3 digits bank code, 2 digits district code, 3 digits branch code, and at last 1 check digit. This number is also printed on the bottom-left of your bank check pages.

Traditionally, banking in Bangladesh has been for the mid to large sized businesses or the professionals in jobs. Ironically, more than ¾th of the economy is out of the reach of formal banking. BRAC Bank took a step to break this tradition of banking and tapped into the true suburb entrepreneurial initiatives. BRAC Bank Limited, traded as 'BRACBANK' on Dhaka Stock Exchange, has been one of the fastest-growing banks in Bangladesh with a particular focus on the SME segment. BRAC Bank takes pride at the highest Moody's Rating among all banks in Bangladesh for five consecutive years.

Remittance Loans

For example, you can use their apps to track your savings, and even make payments online. For the inheriting business risk, SME sector is facing several constrains in terms of growth. Policy level complexity, financial constraints, legal bindings and industry structure are hindering financial institutions to support SME sector.

Leveraging BRAC Bank’s robust pan-Bangladesh network, the bank’s Retail Banking division enjoys strong penetration across thecountry, facilitating both marketing of retail loan products as well as collections. Thedivision also possesses robust credit appraisal standards and procedures withindustry-leading TAT , which stood at an average of 2 days in2017. BRAC Bank is one of the country largest and world‟s 4th largest SME Bank. In a market where traditional banking support was inadequate, these SMEs could find a partner. Since BRAC Bank inception served around 471,618 SME borrowers by lending BDT 291,871 Million through 624 customer touch points !

The process includes information about borrower past dealing with banks, assessing the clients ability to repayment, sources of repayment, net worth and information obtained from Credit Information Bureau approved by Bangladesh Bank. IFC—a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. If applied during working hours, customers can know about loan sanction decisions within a few minutes of application. After loan approval, customers can visit the bank’s empanelled partner outlets to purchase their desired products using the loan facility. Moreover, they can purchase products and services from the bank’s partner outlets using the app and the loan will be disbursed digitally into the partners’ accounts in a few moments.

If you take a personal loan from BRAC Bank, you can now take a personal loan from BRAC Bank at the lowest interest rate as compared to other banks. You can take personal loan from BRAC Bank up to a maximum of Tk 20 lakh. In today's blog I will give you some information about BRAC Bank's personal loan. BRAC Bank offers you a wide range of financial solutions to meet your everyday need.

Within 11 years of establishing it has proved its success through becoming country‟s largest SME finance provider and 4th large SME provider in the world in terms of lending volume. Advanced expansion of the Small and Medium Enterprises can help to cut poverty to a satisfactory level by eliminating various prejudices against labour intensive industry and creating jobs for the skilled manpower in the SME sector. However, the access to financing is still recognized as the leading obstacle to SME growth in Bangladesh, alike most other developing and under-developed countries. Small and medium entrepreneurship have a tremendous potential in empowering potential entrepreneurs and transforming society.

The interest rate varies from 11.25% to 12.50% depending on the loan amount and customer segment. NIRMAN is a loan facility for construction and/or renovation of a residential facility and/or commercial complex for rental purposes under the Equated Monthly Installment loan facility. If you are an emerging entrepreneur looking for a large loan to meet your business needs and have viable security to offer, the APURBO loan facility is a perfect choice. And if all your documents are correct and if you have submitted all the documents correctly, then you can get the personal loan of BRAC Bank within five to seven working days. With our state of art Internet banking app “Astha” you can always check your DPS information and status. Sudden unexpected and unexplained changes in deposit balance maintained by the customer.

All the institutions starting/undertaken small and medium enterprise financing are instructed to gone through some training on an ongoing basis to their capabilities related with various aspects of SMEs. The bank shall prepare standardized set of borrowing and recourse documents for each types of SME financing. The bank shell develops comprehensive credit policies suitably approved by Board of Directors. The policy will cover loan administration combined with documentations process, disbursement systems and appropriate monitoring mechanism. The policy will also revise with job description and job specification of different layer staffs.

Banking system plays a significant and commendable role in the growth and development of economy and its components. For any nation, banking system plays a vital role in the development of its sound economy. To know the home loan interest rate of BRAC bank, please contact them. And the processing fee of a home loan is up to 2% of the approved loan amount , PF will be up to 1.5%. Then you can take a personal loan from BRAC Bank for any of your needs.

Known as a private commercial bank, Midland Bank Limited has been on the preferred list of customers for a long time. Midland Bank has been providing services in different regions including Dhaka with the aim of providing financial support to the customers. In addition to providing financial services, quality banking services such as lockers, various types of loans, Midland bank has already gained a good reputation in the sector for various reasons. BRAC Bank Home Loan is a great option for people who want to buy or renovate a new home or apartment. You can apply for a BRAC Bank home loan through any of the bank’s branches or by calling their 24-hour call center on 16221.

RFCD account offers our local nationals to manage and access foreign currency from anywhere around the world and travel being worry free. Triple Benefits Savings account offers you to grow your deposit at a higher savings rate with an opportunity to enjoy wide range of Alternate Channel services and convenience of Branch Banking. Proof of other bank credit facilities such as loans and credit cards. SME is defined as, “A firm managed in a personalized way by its owners or partners, which has only a small share of its market and is not sufficiently large to have access to the stock exchange for raising capital”.

No comments:

Post a Comment